In today’s data-driven investment landscape, artificial intelligence (AI) and alternative data are reshaping how investors approach the market. AI-driven algorithms and machine learning models have become powerful tools for analysing vast amounts of alternative data, uncovering hidden patterns, and generating actionable insights. By combining the power of AI with alternative data—such as satellite imagery, web traffic, and social media sentiment—investors can gain a competitive edge and make smarter, data-driven decisions.

In this blog, we’ll explore how AI and alternative data intersect to enhance investment strategies, helping investors process complex datasets, predict market trends, and optimise portfolio performance.

What is AI in Investment?

AI in investment refers to the use of advanced algorithms, machine learning models, and data analytics techniques to analyse financial markets, predict trends, and inform investment decisions. AI has the ability to process large datasets in real time, identify patterns, and adapt its strategies based on new information. This makes AI particularly valuable for analysing alternative data, which can be complex and unstructured.

Some common AI-driven investment techniques include:

- Predictive analytics: Using historical and real-time data to forecast market trends and asset prices.

- Natural language processing (NLP): Analysing text from news articles, social media, and earnings reports to gauge sentiment and detect risks.

- Algorithmic trading: Using AI-powered algorithms to execute trades at optimal times based on market conditions and data analysis.

When paired with alternative data, AI enables investors to gain deeper insights into market dynamics, allowing for more accurate predictions and more effective risk management.

Why AI and Alternative Data Are Transforming Investment Strategies

While traditional financial data provides valuable information, it often falls short in capturing the nuances of real-time market activity and emerging trends. Alternative data fills these gaps by offering unique insights into consumer behaviour, company performance, and global events. However, processing alternative data—such as satellite imagery or social media sentiment—can be complex and time-consuming.

This is where AI comes in. AI-powered tools can quickly analyse large datasets, identify correlations, and generate predictive models that help investors stay ahead of market trends. Here’s why the combination of AI and alternative data is transforming investment strategies:

1. Processing Large, Unstructured Datasets

Alternative data often comes in unstructured formats, such as satellite images, social media posts, or transaction records. AI-powered tools can process these large datasets, identify patterns, and convert unstructured data into actionable insights, giving investors a comprehensive view of market activity.

- Example: An AI model processes satellite imagery of factory activity to assess production levels at a major manufacturing facility. By analysing this data, the AI system can predict whether the company is on track to meet earnings expectations, allowing investors to adjust their positions before official reports are released.

2. Predicting Market Trends with Machine Learning

Machine learning models can analyse historical and real-time alternative data to forecast future market trends. These models learn from past data to identify patterns, correlations, and anomalies that may signal shifts in market conditions. By combining alternative data with machine learning, investors can make more accurate predictions about asset prices and market movements.

- Example: A machine learning model analyses credit card transaction data to detect changes in consumer spending patterns. The model predicts a slowdown in spending for a major retail chain, prompting investors to adjust their exposure to retail stocks before earnings reports confirm the trend.

3. Improving Risk Management

AI enhances risk management by providing real-time insights into emerging risks, such as geopolitical events, supply chain disruptions, or consumer sentiment shifts. By analysing alternative data in real time, AI models can detect risks earlier and provide investors with the information they need to mitigate potential losses.

- Example: AI-driven natural language processing (NLP) models scan global news reports and social media platforms to detect growing unrest in a key oil-producing region. This real-time analysis allows energy sector investors to hedge their positions against potential oil price volatility.

4. Enhancing Sentiment Analysis with NLP

AI-powered natural language processing (NLP) is particularly effective in analysing social media sentiment, news articles, and corporate filings. By processing large volumes of text, NLP models can gauge how the public and media are reacting to specific companies, industries, or economic events. This allows investors to gauge market sentiment and make more informed decisions.

- Example: An NLP model analyses thousands of social media posts related to a new tech product launch. The model detects a positive shift in consumer sentiment, signalling potential strong sales. Investors use this data to increase their positions in the tech company before the market reacts.

How AI and Alternative Data Are Being Used in Investment Strategies

Here’s how AI and alternative data are being used to enhance investment strategies across different areas:

1. Algorithmic Trading with Alternative Data

AI-powered algorithmic trading systems can analyse real-time alternative data, such as geolocation data or transaction data, to execute trades automatically based on market signals. By incorporating alternative data into trading algorithms, AI systems can react faster to changes in market conditions and optimise trade execution.

- Example: An AI-driven algorithm analyses transaction data from retail stores to detect sales spikes during a promotional event. The system automatically buys shares in the company before the broader market realises the positive sales trend, generating alpha for the investor.

2. Portfolio Optimization with Predictive Analytics

AI and alternative data can be combined to optimise portfolio performance by predicting how different assets will perform in various market conditions. Machine learning models analyse historical data, social media sentiment, economic indicators, and alternative datasets to identify optimal asset allocations and minimise risk.

- Example: A hedge fund uses an AI model to analyse satellite imagery of agricultural fields, social media sentiment around food supply, and commodity price trends. The model generates a diversified portfolio of agriculture-related stocks and futures that balances risk and return.

3. Real-Time Monitoring of Company Performance

Investors can use AI-powered tools to track company performance in real time by analysing web traffic, geolocation data, and other alternative datasets. AI models continuously monitor these data sources and alert investors to any significant changes, allowing them to make faster and more informed investment decisions.

- Example: AI monitors web traffic data for a leading e-commerce platform. The model detects an unexpected surge in site visits, indicating strong consumer demand. Investors use this real-time insight to adjust their portfolios ahead of the company’s next earnings report.

4. Detecting Fraud and Anomalies

AI models can analyse alternative data to detect fraudulent activities or anomalies that may signal financial irregularities. By identifying suspicious behaviour patterns, AI helps investors avoid companies with potential risks, enhancing overall portfolio performance.

- Example: An AI system analyses transaction data from a global payments company and detects an unusual spike in transaction volume in a specific region. The system flags this as a potential case of fraud, allowing investors to mitigate risk before the company’s stock price is affected.

Real-World Examples of AI and Alternative Data in Action

Example 1: Predicting Earnings with Satellite Imagery

A hedge fund uses AI models to analyse satellite imagery of oil storage tanks in the Middle East. By measuring the amount of oil in storage, the AI model predicts oil supply levels and price movements. This data allows the fund to adjust its energy sector exposure ahead of earnings reports, generating significant returns.

Example 2: Detecting Consumer Trends with Web Traffic Data

An AI-driven investment firm tracks web traffic data for major online retailers during the holiday shopping season. The firm’s AI models detect a spike in traffic for one particular retailer, signalling strong holiday sales. Based on this alternative data, the firm increases its position in the retailer before the market adjusts to the new information.

Example 3: Managing Risk in Global Supply Chains

A global investment firm uses AI to monitor geolocation data for shipping routes and port activity. The firm’s machine learning models detect a slowdown in container traffic at a major port, signalling potential supply chain disruptions. This early warning allows the firm to adjust its positions in logistics and manufacturing companies, mitigating risk before the disruption impacts the broader market.

Challenges of Using AI and Alternative Data in Investing

While AI and alternative data offer significant benefits, there are challenges to consider:

1. Data Quality and Accuracy

AI models are only as good as the data they are trained on. Investors must ensure that the alternative data they use is accurate, reliable, and up to date. Poor-quality data can lead to inaccurate predictions and investment decisions.

2. Complexity and Expertise

Implementing AI-driven strategies requires specialised expertise in data science, machine learning, and financial markets. Investors must have the resources and tools to develop, test, and optimise AI models effectively.

3. Cost of Data Acquisition and Technology

Acquiring high-quality alternative data and building AI infrastructure can be expensive, particularly for smaller investors. Investors need to assess whether the potential returns from AI-driven strategies justify the costs.

The Future of AI and Alternative Data in Investing

As AI technology advances and alternative data becomes more accessible, the intersection of these two trends will continue to reshape the investment landscape. With AI-driven models becoming more sophisticated and capable of processing larger datasets, investors will be able to make faster, more accurate predictions and optimise their portfolios more effectively.

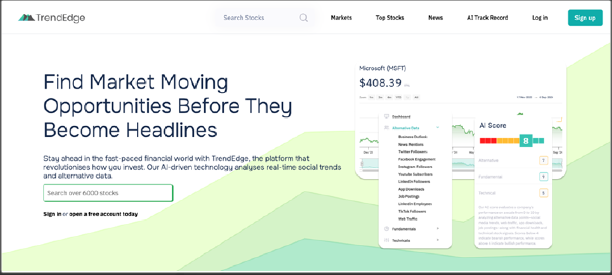

Platforms like TrendEdge are leading the way in providing investors with AI-powered tools and access to cutting-edge alternative data, helping them stay ahead of market trends and enhance their investment strategies.

The combination of AI and alternative data is revolutionising how investors approach the market. By leveraging machine learning models to analyse complex datasets—such as satellite imagery, web traffic, and social media sentiment—investors can make more informed decisions, improve risk management, and enhance portfolio performance.